Fearless Leadership

Empowered to make decisions

that protect your business.

Management Liability

Founded in 1990, our department possesses a deeper understanding of hard-to-place risks than most. When exposed to a wide array of risks, you want customized coverage with a carrier you can count on to be there now and into the future. That is why RSUI has prevailed as the trusted market for our customers for over 30 years.

Company Types

Our strong financial position and sound underwriting philosophy allow us the capacity to consider nearly any risk within three sectors of businesses: non-profit, private, and public companies.

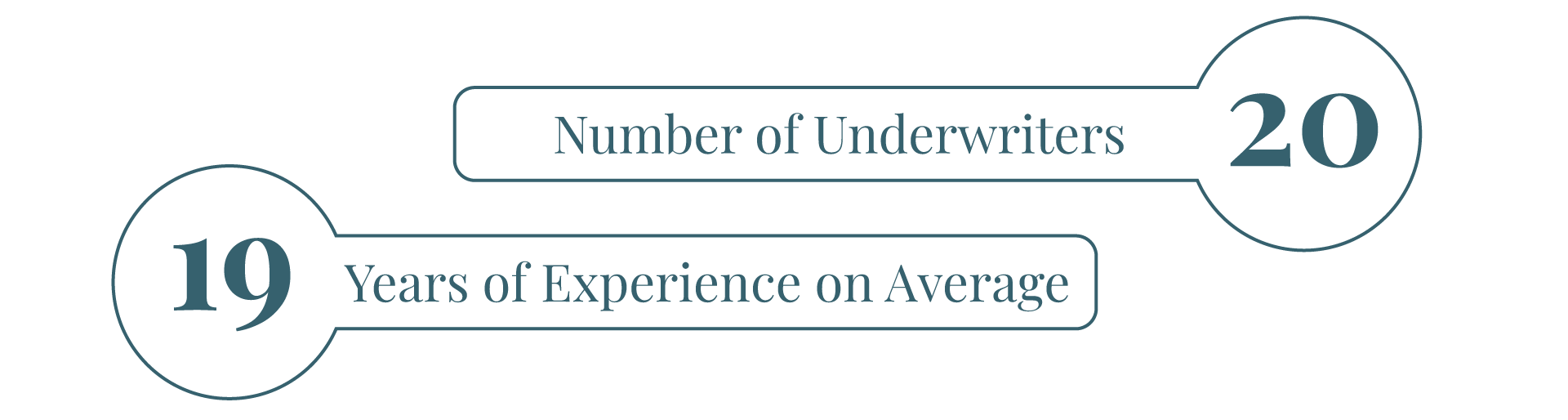

Our Management Liability team specializes in tough-to-place risks that require expertise, creativity, and an adaptable approach to underwriting.

Non-Profit Companies

Non-profit companies require management liability insurance because it mitigates risks that leaders may face and allows them to focus on the organization’s mission. Coverage with RSUI also helps attract qualified board members to the cause. Our book includes a wide range of accounts, including, but not limited to healthcare, educators, universities and colleges, and public officials. We will consider nearly any class of business.

Private Companies

RSUI’s policies offer protection for private companies and the personal assets of directors and officers against a wide array of claims. This allows companies to focus on returning shareholder value and serving their employees to the best of their ability. Our underwriters review submissions on an individual basis and have the experience and authority to consider almost any risk.

Public Companies

By nature, public companies are large, highly-regulated entities that face a wide range of scrutiny. RSUI is an excess-only carrier, often entertaining risks that standard lines turn away from.

Our portfolio encompasses a wide range of placements from Fortune 1000 companies, all the way down to micro-cap companies, and everything in-between. We are consistent in the classes of businesses we write and value long-term relationships with our partners.

Claims Service

One of the keys to sustaining strong, trusting relationships with our customers is our ability to handle claims with care. Expert claim handlers provide best-in-class customer service through high responsiveness and attention to detail. Our underwriters work closely with highly experienced claims professionals dedicated to management liability claims.

If you are a retail agent needing assistance with a hard-to-place risk, please contact one of our appointed wholesale brokers about coverage.

Kym Hadzick

Management Liability, Senior Vice President

Broker Resources